The Indian government has recently revised the income tax slabs for the financial year 2025-26 (assessment year 2026-27) under the new tax regime. These changes aim to provide significant relief to taxpayers and stimulate economic growth by increasing disposable income.

New Income Tax Slabs for FY 2025-26:

| Annual Income (₹) | Tax Rate |

|---|---|

| Up to 4,00,000 | Nil |

| 4,00,001 to 8,00,000 | 5% |

| 8,00,001 to 12,00,000 | 10% |

| 12,00,001 to 16,00,000 | 15% |

| 16,00,001 to 20,00,000 | 20% |

| 20,00,001 to 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Additionally, the standard deduction has been increased from ₹50,000 to ₹75,000. This means that individuals with an annual income up to ₹12,75,000 will not be liable to pay any income tax after accounting for the standard deduction.

These adjustments are part of the government’s strategy to boost consumer spending and economic activity by enhancing the purchasing power of the middle class.

Please note that these revised slabs apply to the new tax regime. The old tax regime remains unchanged, allowing taxpayers to choose between the two based on their financial preferences and eligibility for exemptions.

For a detailed comparison between the old and new tax regimes, you may refer to the official income tax portal or consult with a tax professional to determine the most beneficial option for your financial situation.

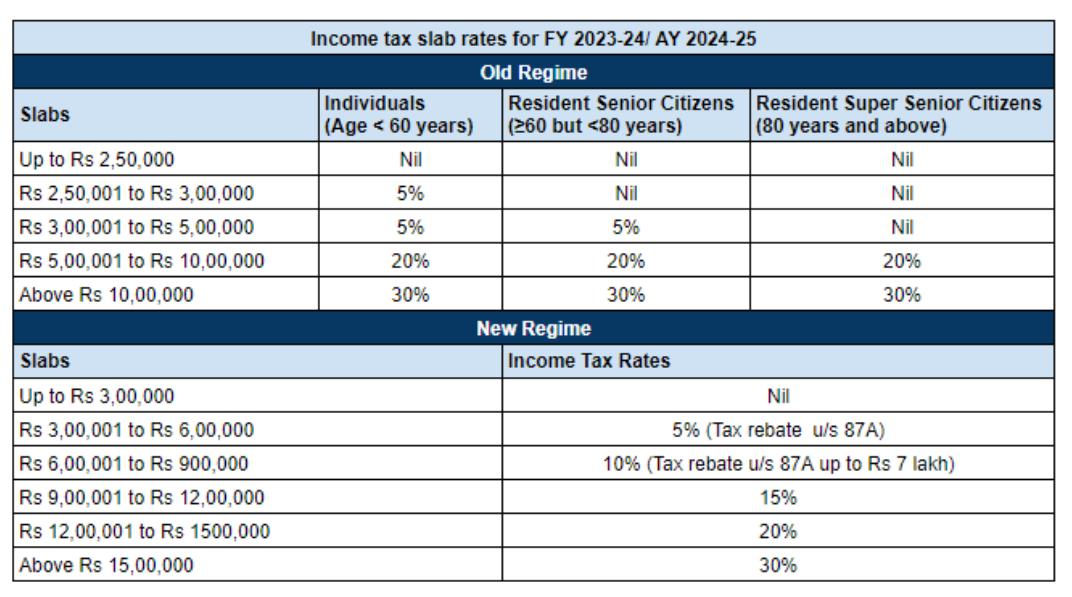

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Regime Tax Rates)

The income tax slabs are different under the old and the new tax regimes. Further, the slab rates under the old tax regime are divided into three categories

- Indian Residents aged < 60 years + All the non-residents

- 60 to 80 years: Resident Senior citizens

- More than 80 years: Resident Super senior citizens

Budget 2024 Update: Tax Slabs Under New Regime Updated

The Budget 2024 has revised the tax slabs in the New Regime, providing taxpayers with an extra opportunity to save Rs. 17,500 in taxes. Additionally, the standard deduction has been raised to Rs. 75,000 under this regime and the family pension deduction has been increased to Rs. 25,000 from Rs. 15,000. This is applicable for the FY 2024-25. The comparison between the tax slabs post-budget and pre-budget is as follows:

|

Tax Slab for FY 2023-24 |

Tax Rate |

Tax Slab for FY 2024-25 |

Tax Rate |

|

Upto ₹ 3 lakh |

Nil |

Upto ₹ 3 lakh |

Nil |

|

₹ 3 lakh – ₹ 6 lakh |

5% |

₹ 3 lakh – ₹ 7 lakh |

5% |

|

₹ 6 lakh – ₹ 9 lakh |

10% |

₹ 7 lakh – ₹ 10 lakh |

10% |

|

₹ 9 lakh – ₹ 12 lakh |

15% |

₹ 10 lakh – ₹ 12 lakh |

15% |

|

₹ 12 lakh – ₹ 15 lakh |

20% |

₹ 12 lakh – ₹ 15 lakh |

20% |

|

More than 15 lakh |

30% |

More than 15 lakh |

30% |

What is an Income Tax Slab?

In India, the Income Tax applies to individuals based on a slab system, where different tax rates are assigned to different income ranges. As the person’s income increases, the tax rates also increase. This type of taxation allows for a fair and progressive tax system in the country. The income tax slabs are revised periodically, typically during each budget. These slab rates vary for different groups of taxpayers.

Let us take a look at all the slab rates applicable for FY 2023-24(AY 2024-25).

For Old Regime, a tax rebate up to Rs.12,500 is applicable if the total income does not exceed Rs 5,00,000 (not applicable for NRIs)

NOTE:

- Income tax exemption limit is

- up to Rs 2,50,000 for Individuals, HUF below 60 years aged and NRIs.

- up to Rs 3,00,000 for senior citizens aged above 60 years but less than 80 years.

- up to Rs 5,00,000 for super senior citizens aged above 80 years.

- Surcharge and cess will be applicable over and above the tax rates

However, under the new tax regime rebate is up to Rs.25,000 is applicable if the total income does not exceed Rs 7,00,000. (not applicable for NRIs)

* Tax rebate equivalent to an amount, tax payable is when the total income exceeds Rs 7,00,000. (not applicable for NRIs)

NOTE:

- Income tax exemption limit is up to Rs 3,00,000 for Individuals, HUF opting for the new regime.

- Surcharge and cess will be applicable over and above the tax rates.

Comparison of Tax Rates Under New Tax Regime & Old Tax Regime

|

|

Old Tax Regime (FY 2022-23 and FY 2023-24) |

New Tax Regime |

|||

|

Income Slabs |

Age < 60 years & NRIs |

Age of 60 Years to 80 years |

Age above 80 Years |

FY 2022-23 |

FY 2023-24 |

|

Up to ₹2,50,000 |

NIL |

NIL |

NIL |

NIL |

NIL |

|

₹2,50,001 – ₹3,00,000 |

5% |

NIL |

NIL |

5% |

NIL |

|

₹3,00,001 – ₹5,00,000 |

5% |

5% |

NIL |

5% |

5% |

|

₹5,00,001 – ₹6,00,000 |

20% |

20% |

20% |

10% |

5% |

|

₹6,00,001 – ₹7,50,000 |

20% |

20% |

20% |

10% |

10% |

|

₹7,50,001 – ₹9,00,000 |

20% |

20% |

20% |

15% |

10% |

|

₹9,00,001 – ₹10,00,000 |

20% |

20% |

20% |

15% |

15% |

|

₹10,00,001 – ₹12,00,000 |

30% |

30% |

30% |

20% |

15% |

|

₹12,00,001 – ₹12,50,000 |

30% |

30% |

30% |

20% |

20% |

|

₹12,50,001 – ₹15,00,000 |

30% |

30% |

30% |

25% |

20% |

|

₹15,00,000 and above |

30% |

30% |

30% |

30% |

30% |

Income Tax Slab Rates For FY 2022-23 (AY 2023-24)

a. New Tax regime until 31st March 2023

|

Income Slabs |

Individuals (for all age categories) |

|

Up to Rs 2,50,000 |

Nil |

|

Rs 2,50,001 – Rs 5,00,000* |

5% |

|

Rs 5,00,001 – Rs 7,50,000 |

10% |

|

Rs 7,50,001 – Rs 10,00,000 |

15% |

|

Rs 10,00,001 – Rs 12,50,000 |

20% |

|

Rs 12,50,001 – Rs 15,00,000 |

25% |

|

Rs 15,00,001 and above |

30% |

* Tax rebate up to Rs.12,500 is applicable if the total income does not exceed Rs 5,00,000 (not applicable for NRIs)

Refer to the above image for the rates applicable to FY 2023-24 (AY 2024-25) for the upcoming tax filing season.

b. Old Tax regime

Income tax slabs for individuals aged below 60 years & HUF

|

Income Slabs |

Individuals of Age < 60 Years and NRIs |

|

Up to Rs 2,50,000 |

NIL |

|

Rs 2,50,001 – Rs 5,00,000 |

5% |

|

Rs 5,00,001 to Rs 10,00,000 |

20% |

|

Rs 10,00,001 and above |

30% |

NOTE:

- The income tax exemption limit is up to Rs 2,50,000 for Individuals, HUF below 60 years aged, and NRIs.

- Surcharge and cess will be applicable.

Income tax slab for individuals aged above 60 years to 80 years

|

Income Slabs |

Individuals of Age 60 Years to 80 Years |

|

Up to Rs 3,00,000 |

NIL |

|

Rs 3,00,001 – Rs 5,00,000 |

5% |

|

Rs 5,00,001 to Rs 10,00,000 |

20% |

|

Rs 10,00,001 and above |

30% |

NOTE:

- The income tax exemption limit is up to Rs.3 lakh for senior citizens aged above 60 years but less than 80 years.

- Surcharge and cess will be applicable

Income tax slab for Individuals aged more than 80 years

|

Income Slabs |

Individuals of Age above 80 Years |

|

Up to Rs 5,00,000 |

NIL |

|

Rs 5,00,001 to Rs 10,00,000 |

20% |

|

Rs 10,00,001 and above |

30% |

NOTE:

- Income tax exemption limit is up to Rs 5 lakh for super senior citizen aged above 80 years.

- Surcharge and cess will be applicable

Revised Income Tax Slab Rate AY 2024-25 (FY 2023-24)– For New Regime

|

Income Slabs |

Income Tax Rates |

|

Up to Rs 3,00,000 |

Nil |

|

Rs 3,00,000 to Rs 6,00,000 |

5% on income which exceeds Rs 3,00,000 |

|

Rs 6,00,000 to Rs 900,000 |

Rs. 15,000 + 10% on income more than Rs 6,00,000 |

|

Rs 9,00,000 to Rs 12,00,000 |

Rs. 45,000 + 15% on income more than Rs 9,00,000 |

|

Rs 12,00,000 to Rs 1500,000 |

Rs. 90,000 + 20% on income more than Rs 12,00,000 |

|

Above Rs 15,00,000 |

Rs. 150,000 + 30% on income more than Rs 15,00,000 |

What are the Major Procedural Changes in Filing of Income Tax Return from FY 2022-23 to FY 2023-24?

- For FY 2022-23, the default regime used to be the Old tax regime, if you wanted to go for the New tax regime, you were required to submit Form 10-IE. After the due date, you have to mandatorily file under the old regime only.

- For FY 2023-24, the default regime changed to the new tax regime, now if you want to file the return under the old tax regime by claiming all the deductions, exemptions, and losses, then you have to file Form 10-IEA within the due date. After the due date, you have to mandatorily file under the new regime by giving up on most of the deductions and exemptions and all losses.

How to Calculate Income Tax from Income Tax Slabs?

Illustration 1: Rohit has a total taxable income of Rs 8,00,000. This income has been calculated by including income from all sources, such as salary, rental income, and interest income. Deductions under Section 80 have also been reduced. Rohit wants to know his tax dues as per the old regime for FY 2023-24 (AY 2024-2025).

|

Income Tax Slabs |

Tax Rate |

Tax Amount |

|---|---|---|

|

*Income up to Rs 2,50,000 |

No tax |

– |

|

Income from Rs 2,50,000 – Rs 5,00,000 |

5% (Rs 5,00,000 – Rs 2,50,000) |

Rs 12,500 |

|

Income from Rs 5,00,000 – 10,00,000 |

20% (Rs 8,00,000 – Rs 5,00,000) |

Rs 60,000 |

|

Income more than Rs 10,00,000 |

30% |

– |

|

Tax |

|

Rs 72,500 |

|

Cess |

4% of Rs 72,500 |

Rs 2,900 |

|

Total tax in FY 2023-24 (AY 2024-25) |

Rs 75,400 |

|

Note:

Please note that Rohit is an individual taxpayer assessee having an income tax exemption of Rs 2,50,000. For other taxpayer assessees, i.e. senior citizens and super senior citizens, the Income-tax limit for availing the exemption would be Rs 3,00,000 & Rs 5,00,000, respectively.

Individuals with net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u/s 87A under the old tax regime, i.e. tax liability will be NIL.

Important Points to note if you select the new tax regime:

- Please note that the tax rates in the New tax regime are the same for all categories of Individuals, i.e. Individuals, Senior citizens, and Super senior citizens.

- Individuals with net taxable income less than or equal to Rs 7 lakh will be eligible for tax rebate u/s 87A, i.e. tax liability will be NIL under the new regime.

What is a Surcharge and the Applicable Rates?

In case the income exceeds a certain threshold, the additional taxes are to be paid over and above existing tax rates. This is an additional tax on the High Income Earners.

Surcharge rates are as below:

10% of Income tax if total income > Rs.50 lakh and < Rs.1 crore,

15% of Income tax if total income > Rs.1 crore and < Rs.2 crore,

25% of Income tax if total income > Rs.2 crore and < Rs.5 crore,

37% of Income tax if total income > Rs.5 crore

*In Budget 2023, the highest surcharge rate of 37% has been reduced to 25% under the new tax regime. (applicable from 1st April 2023)

- Surcharge rates of 25% or 37% will not apply to the income from dividends and capital gains taxable under sections 111A (Short Term Capital Gain on Shares), 112A (Long Term Capital Gain on Shares), and 115AD (Tax on the income of Foreign Institutional Investors). Therefore, the highest surcharge rate on the tax payable for such incomes will be 15%.

- The surcharge rate for an Association of Persons (AOP) consisting entirely of companies will also be limited to 15%.

Additional Health and Education cess at the rate of 4% will be added to the income tax liability.